nc estimated tax payment due dates

Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th months of the taxable year. Likewise pursuant to Notice.

Liberty Tax 1327 5th Ave Garner Nc Facebook

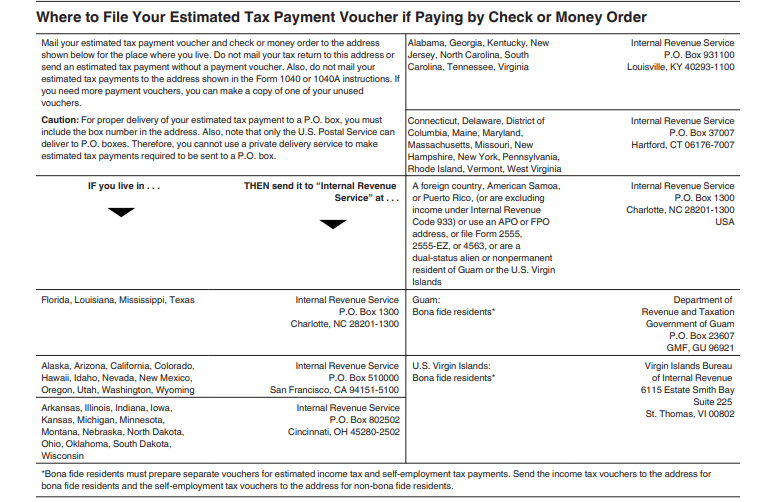

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

. Cooperative or Mutual Association. Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. 7-2-121Limitation on claiming of credits and tax rebates.

Federal and NC April 15 and later Tax Filing and Payment Deadlines Extended to July 15. For calendar year filers. Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020 to July 15 2020.

Your card statement will show two separate. Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax. WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17.

Update May 6 2020. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

At that point you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17. At that point you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17. The North Carolina Department of Revenue NCDOR announced that it will extend the April 15 tax filing and payment deadline to May 17 2021 for.

7-2-122Estimated tax due. Income allocation and apportionment. There is no need.

You can also pay your estimated tax online. You can also pay your estimated tax online. The NCDOR has issued a notice providing that as a result of new law.

Cooperative or Mutual Association. You may be able to skip filing and paying the estimated tax payment due on January 17 2023 if you have filed your annual tax return and paid your full obligation by the 17th. Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th.

March 18 2021 509 pm.

Power Up Your Business Nc Department Of Revenue

Estimated Tax Due Dates Do I Still Need To Pay

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

Quarterly Tax Calculator Calculate Estimated Taxes

North Carolina Pass Through Entity Tax Greensboro Cpa Firm Nc Cpa

Strategies For Minimizing Estimated Tax Payments

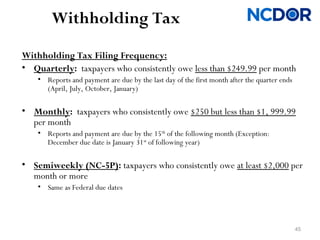

North Carolina Withholding Forms And Instructions For Tax Year 2013

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Irs Reminder Q3 Estimated Tax Payments Due On Sept 15

First Filing Deadline Of 2012 Final 2011 Estimated Tax Payment Due Jan 17 Don T Mess With Taxes

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

State Income Tax Deadlines In 2020 New Due Dates

Federal Income Tax Deadline In 2022 Smartasset

Estimated Quarterly Tax Payments 1040 Es Guide Dates

I Scheduled My Md Tax Payment For 7 6 20 Via Turbotax After Filing I Can T Find This Info The Scheduling Of The Payment Anywhere On The Site Where Do I Look

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet